CORPORATE HISTORY

40 Years of Real Estate & Investment Services

Innovating. Executing. Maximizing Value.

1980s

Capital Guidance launched U.S. real estate investments and is equity partner in Madison Realty Partnership

Purchased two prime office buildings at 260-261 Madison Avenue in Manhattan

Acquired 1100 Louisiana, a 55-story, 1.2 million sq. ft. office tower in Houston, Texas

Successful transformation of three underperforming shopping centers in partnership with Trammel Crow spurred the formation of Madison Marquette

1990s

Madison Realty Partnership is created as a specialty retail developer establishing itself as the industry leader of place-based retail lifestyle mixed-use developments

Repositioned University Park Village in Fort Worth, Texas from a neighborhood shopping center to a lifestyle destination

Completed adaptive reuse project at 278 Post Street in San Francisco’s Union Square, transforming historic 7-story building into a mixed-use property

Transformed The Shops at Waldorf Center in Waldorf, Maryland from an underperforming shopping center into a premier open-air retail destination

Reimagined Gardens on El Paseo in Palm Desert, California into an outdoor lifestyle shopping experience

Reinforced the company’s ability to transform underperforming locations into successful lifestyle centers with Bell Tower Shops in Fort Myers, Florida

Madison Marquette is formed after a strategic acquisition to service the firm’s retail center developments

- Madison Partners acquired Minneapolis-based property management firm Marquette Partners in 1995 to form Madison Marquette

- Madison Marquette combined third-party investment management services of Marquette Partners to Madison Partner’s owner’s perspective as an investment manager and developer

Grew national portfolio across the U.S. through a series of acquisitions and joint ventures, and growth on the East and West coasts

- Acquired Hollis & Associates, a Newport Beach, California-based property management firm with 180 employees and 6 million square feet of assets

- U.S. portfolio grew to 20 million sq. ft. under ownership and/or management from Florida to California

2000s

Pioneered distinct destinations that transformed and improved communities

Redeveloped Asbury Park Boardwalk into 320,000 sq. ft. mixed-use landmark in Asbury Park, New Jersey

Established a dynamic new mixed-used hub of commerce and community at Bay Street in Emeryville, California

Developed Cityline at Tenley in Washington, DC., one of several transformative adaptive reuse projects at urban infill locations completed around the U.S.

Purchased Manhattan Village in Manhattan Beach, California and enhanced the 550,000 sq. ft. center into a successful upscale resident and visitor destination

2010s

Developed, enhanced and invested in marquee properties with creativity and innovation as hallmark of our developments

Investment and leasing at Mercato in Naples, Florida transformed the location from 60% occupancy to the region’s premier retail, dining and entertainment destination

Phase I completed at District Wharf in Washington, DC. a transformative $2 billion, 3.5 million sq. ft. mixed-use waterfront development

Developed One Light in Baltimore, Maryland, the city’s first mixed-use skyscraper

Transformed Oxbow Public Market in Napa, California from a mall food court into successful modern, healthy and artisanal dining experience in partnership with retail marketplace developer Steve Carlin

District La Brea establishes creative urban retail district in Los Angeles, California through an 11-building adaptive reuse of historic and underutilized structures

Launched new programs, formed strategic partnerships and refocused on our core strength as a leading investor, developer, and strategic advisor for mixed-use, retail, residential and office properties.

- Madison Marquette merger with PMRG formed a single new fully-integrated commercial real estate firm operating across the U.S.

- Madison Marquette merged with The Roseview Group adding capital markets advisory and corporate services

Grew health care sector

Expanded national healthcare development with construction of DeSoto Transitional Rehabilitation Center, a 100-bed transitional skilled nursing facility in Desoto, Texas

Developed Hidden Springs, a luxury senior living community offering independent and assisted living, and memory care in the Dallas suburb of McKinney, Texas

Acquired a Portfolio of six senior living communities in joint venture with GFH Financial Read More

Read More

Read More

Read More

Read More

Read More

Read More

2020s

Launched Lemonade, Surplus Property Acquisition Program to reposition portfolios of vacant or soon-to-be-vacant corporate-owned properties that are single-tenant stand-alone retail uses

Acquired Senior Living & Healthcare properties

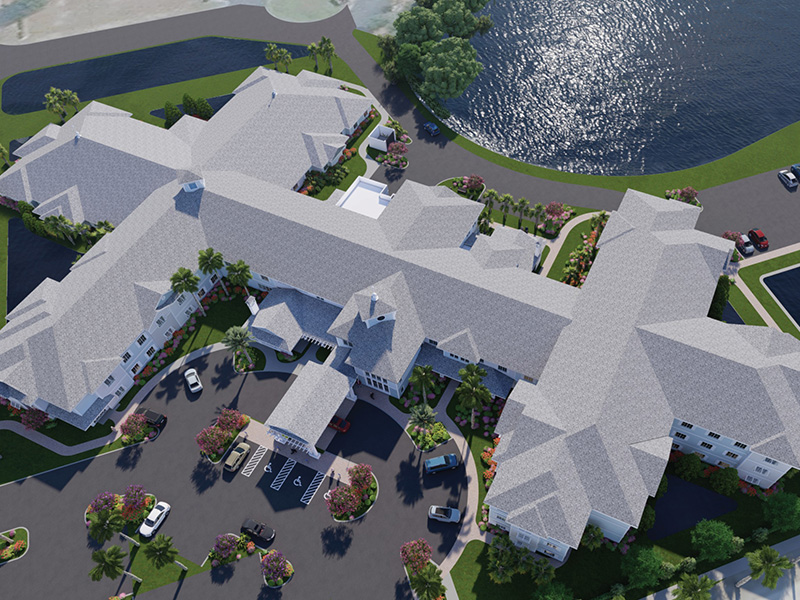

- Added expansive senior living community in Punta Gorda Isles, Florida Read More

- Grew portfolio of senior living communities in California, Washington, Michigan, Florida and Texas

Launched Madison Highland Live/Work Lofts to transform underperforming office buildings into best in-class loft-style apartments

- Purchased former office building in ) Washington, DC to convert to Live/Work lofts Read More

Expanded Evergreen Fund investment series with new acquisitions of workforce housing and office buildings

- Acquired 380-unit apartment community in Wilmington, North Carolina as part of workforce housing strategy Read More

- Acquired office portfolio in Coconut Grove, Florida Read More

Developing large transformative mixed-use properties to create unique community assets where people love to spend time and businesses thrive

Phase II of District Wharf opens, a $3.6 billion, 3.5 million sq. ft. mixed-use waterfront development in Washington, DC

Avison Young acquires office and industrial property management, agency leasing and project management services Read More

Madison becomes a capital partner in Lemonade Investment Management, and control is transferred to former Roseview Group partners that joined our firm as part of the 2019 merger.

Madison’s retail property management, leasing, specialty leasing, marketing, and research teams joined Avison Young’s platform deepening our partnership and relationships.